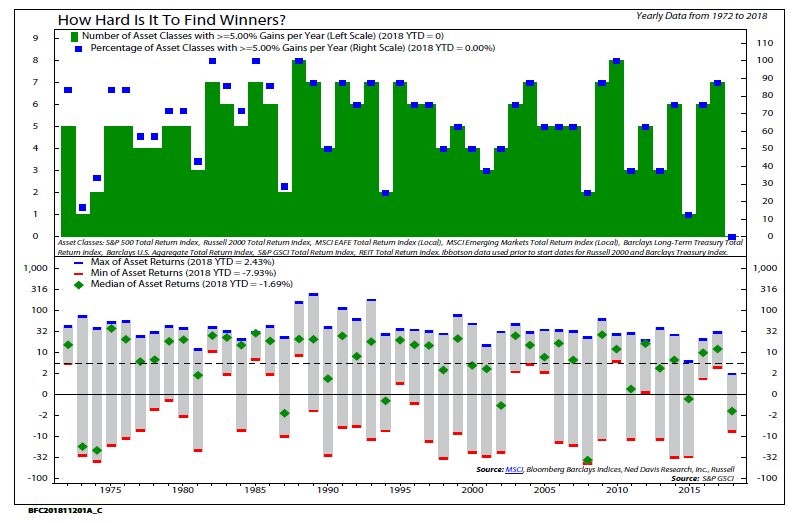

I found the chart below (from Ned Davis Research NDR.com) to be fascinating. It is a chart that only a financial nerd would love but I’ll explain more.

OK, so there’s a lot going on here (too much some might say). But I think it does a very good job of explaining how lousy the “market” has been this year. And by the “market”, I mean the broad collection of the major asset classes.

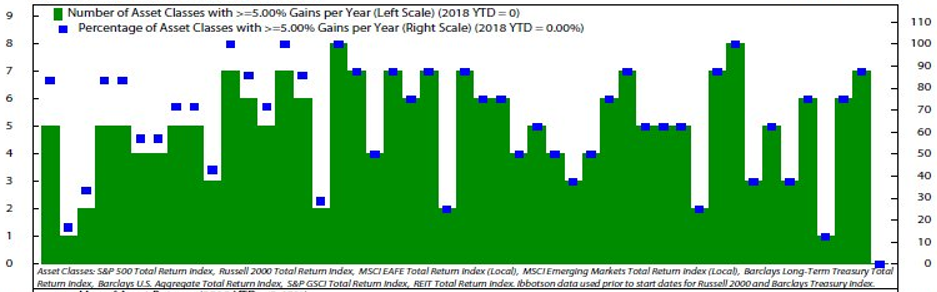

Let’s start with top section. The green bar shows the number of asset classes (left scale) with gains equal or greater than 5%. Typically, there is always something that is doing at least moderately good. (example: stocks go down, bonds typically do well) – not this year! Nothing, nada, zilch. This hasn’t happened any other time during the period covered in the chart (1975 to YTD 2018).

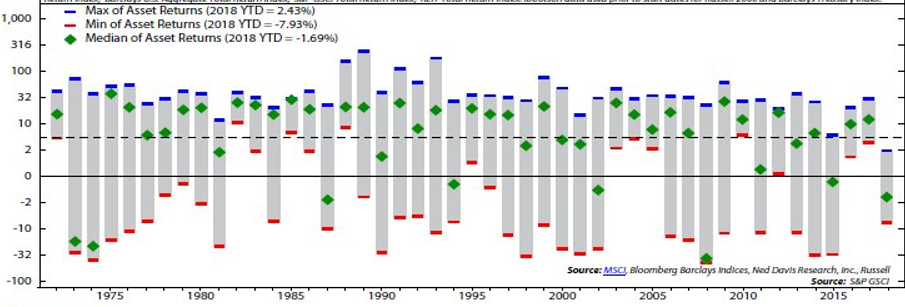

The next section dives deeper into the returns during the period. The blue line shows the best asset class (notice the “best” this year is worse than any other year). The red line is the worst asset class – there might be some solace for a diversified investor that there have been many years with worse returns than this year (just not any with such a collection of mediocre to moderately bad ones). The green diamond shows the median of asset class returns – here the news is again not very good, most asset classes are negative this year. During the financial crisis, tech bubble, 1973-74 bear market, stocks did much worse than now – but something else did very well (bonds, commodities, etc.)

What to do? As our recently departed President George H.W. Bush would say – “stay the course”. As equity classes have declined (or barely risen), their valuations have improved. We expect some of the asset classes with better valuations (emerging markets for example) to look more like past years (with volatility along the way). Some asset classes (U.S. stocks and bonds) may have lower returns, on average, for a number of years as high valuations and low interest rates work themselves out. Overall, though, we expect diversification to work again.

Douglas M. Lynch, CPA, CFA, CFP