Time-Bucketing A Retirement Investing Plan Retirement is one of the biggest transitions of life, and it naturally brings up a lot of questions. For many people, the most pressing is whether existing savings will be enough to provide the life they want, for the entire length of retirement. The traditional Read More…

Diversification

I Bond Update

We put together a video to provide a quick reminder/update on the great opportunity in I Bonds in today’s current high inflation environment. As noted, the current rate of 7.1% will be earned during the first 6 months and it is virtually certain that the rate during the next 6 Read More…

7.1% Rate on A Safe Investment! I Bonds Deserve Attention

Treasury I Bonds are estimated to have a 7.1% rate beginning November 1, 2021. This is much better than comparable alternatives. If you have more than a nominal amount parked in checking & saving accounts or money market funds, you have bemoaned that you are earning 0% (or close to) Read More…

Let’s Get Out of The Market Until Things Settle Down!

The U.S. just experienced the six worst weekly jobless claims in history – prior to 2020, the worst reading was 695,000 in 1982. The last six weeks have ranged between 3.3 and 6.8 million jobs lost each week (exceeding the prior record by multiples). First quarter GDP declined 4.8% which Read More…

Market Update 2020-02-28

There’s an old saying that the stock market goes up like an escalator and down like an elevator. There haven’t been too many weeks in which this was more true than this one. Unless you’ve been in a cave with no TV, you’re aware of the steep market selloff due Read More…

Book Review: The Bogleheads’ Guide to the Three-Fund Portfolio

This article may resemble a plump turkey writing about how to prepare a perfect Thanksgiving dinner (and I appreciate limiting further comparisons of the writer to a turkey). I am writing to review a book I recently finished – The Bogleheads’ Guide to the Three-Fund Portfolio. The author is part Read More…

The (Moderately) Terrible, Horrible, No Good, Very Bad Capital Markets

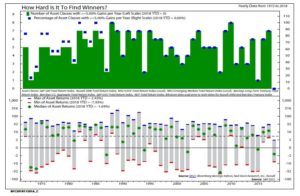

I found the chart below (from Ned Davis Research NDR.com) to be fascinating. It is a chart that only a financial nerd would love but I’ll explain more. OK, so there’s a lot going on here (too much some might say). But I think it does a very good job Read More…

Diversification Means Always Having To Say You’re Sorry

The S&P 500 is up 6.4% this year through 7/31/18. Great news, right? Yes if you were primarily invested in a S&P 500 Index fund. Even better if you are tilted toward U.S. growth stocks. If invested elsewhere, not so much. The following chart shows the year to date returns Read More…