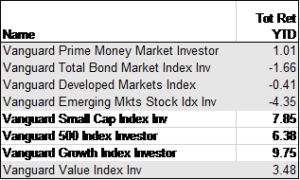

The S&P 500 is up 6.4% this year through 7/31/18. Great news, right? Yes if you were primarily invested in a S&P 500 Index fund. Even better if you are tilted toward U.S. growth stocks. If invested elsewhere, not so much. The following chart shows the year to date returns for index funds representing a number of broad assets classes (through 7/31/18):

The S&P 500 is up 6.4% this year through 7/31/18. Great news, right? Yes if you were primarily invested in a S&P 500 Index fund. Even better if you are tilted toward U.S. growth stocks. If invested elsewhere, not so much. The following chart shows the year to date returns for index funds representing a number of broad assets classes (through 7/31/18):

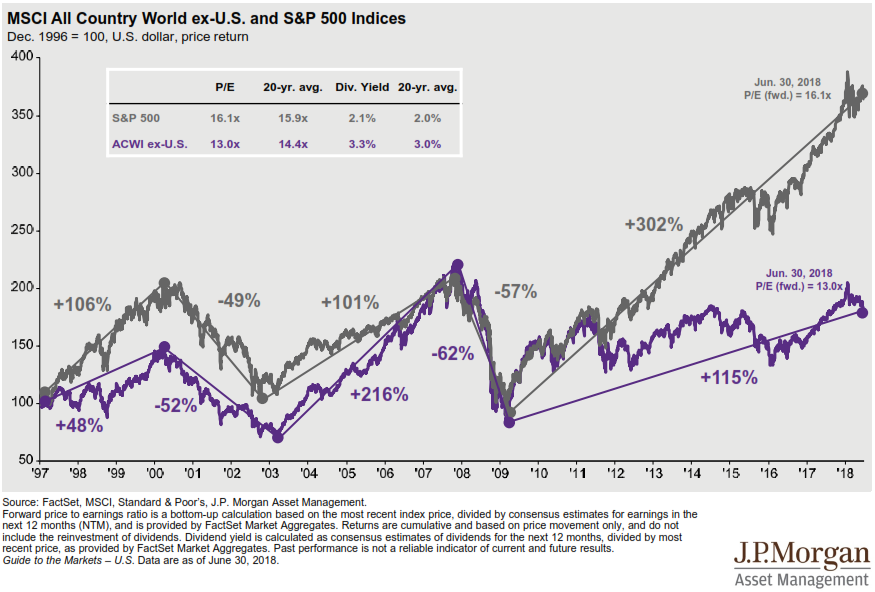

I borrowed the title of this article from one of my favorite financial writers, Michael Kitces, who may have borrowed it from someone else. Diversification means there will always be areas of your portfolio doing better and worse than others. Never is this sentiment more obvious than when U.S. stocks are leading other asset classes as they have been recently. This is because of the home country bias of most investors. They turn on the TV or internet and returns of the U.S. stock market are what is typically shown when discussing “the market”. The reality is that different stock markets can vary significantly. The chart below compares returns of U.S. and non-U.S. stocks since 1997.

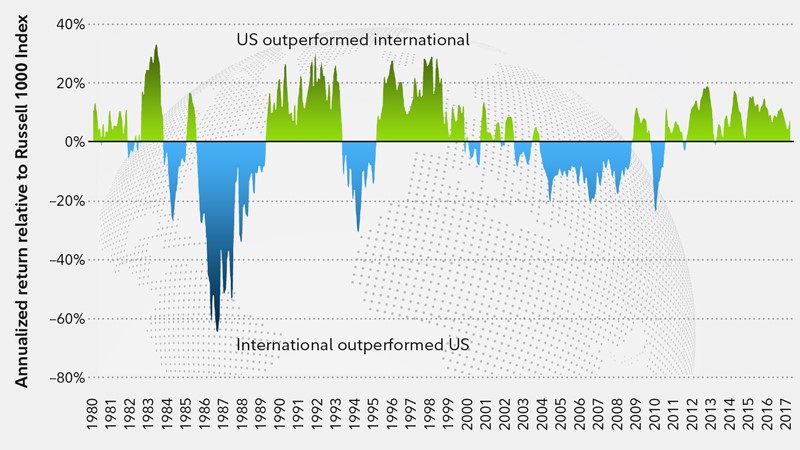

This chart shows that since the stock market bottom in 2009, U.S. stocks are up over 300% vs. 115% for non-U.S. stocks. History has shown that these long periods of outperformance for U.S. and non-U.S. stocks swing back and forth (see chart below). We continue to believe that the phrase “this time is different” is a dangerous one and don’t see a reason that U.S. outperformance will continue indefinitely, especially when considering that non-U.S. stocks are currently more attractive from a valuation standpoint. That said, markets can certainly try the patience of advisors preaching the wisdom of diversification (as we have seen recently).

Source: Fidelity Investments

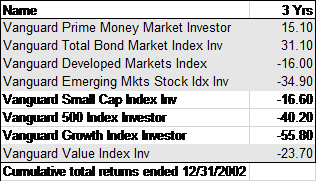

While no two time periods are the same and it is dangerous to compare a market bubble to current markets, recent performance of U.S. growth stocks does call to mind similar frustration during the late 1990’s as technology stocks roared and the rest of the market performed poorly. That was followed by a reversal as shown in the chart below which shows performance for the same asset classes (shown at the beginning of this article) for the 3 years following the tech stock bubble being popped:

In hindsight, technology stocks in 1999 were absurdly overvalued. We believe investors in the future will look back and appreciate having a broadly diversified portfolio. How long it takes to get to that point is the magical question that unfortunately can’t be answered without the benefit of hindsight.

Douglas M. Lynch, CPA, CFA, CFP