Clients love when we talk about how long they are going to live. Don’t they? Probably a fair share would rather be having a root canal done than having this discussion. But it’s an important question.

When someone asks how much they need for retirement, the answer is easy – give me your precise spending, rate of return (and sequence of those returns), assets, and how long you will live. Throw in what future tax rates will be for good measure. Unfortunately, in real life several of those numbers are unknown.

When my great grandfather, John J. Lynch was born in 1885 his life expectancy at birth was approximately 42 years. The following are the life expectancies at birth for: my grandfather 47 years, my father 65 years, me 70 years, my son 77 years. By the way, my great grandfather (who the statistics predicted should live to 42) lived to see his 98th birthday. Interesting statistics aside, there are some really important takeaways – life expectancies have increased dramatically over the past 100+ years. There is little reason to believe this will not continue in the future and there are numerous medical technologies in development that make this very likely. This has implications for the young but also for those nearing or early in retirement. We have rarely had a client tell us to add a couple years onto their life expectancy assumptions but have had many scoff at running a projection to age 90. This is sometimes for reasonably good reasons (lifetime of smoking, significant current health issues, etc.), sometimes for partially valid but not completely strong reasons (parents passed away in their 60’s), and sometimes purely for avoidance reasons (I don’t want to reduce my spending now so I’ll assume a shorter life). Point of fact, those nearing retirement should assume a life expectancy beyond age 90.

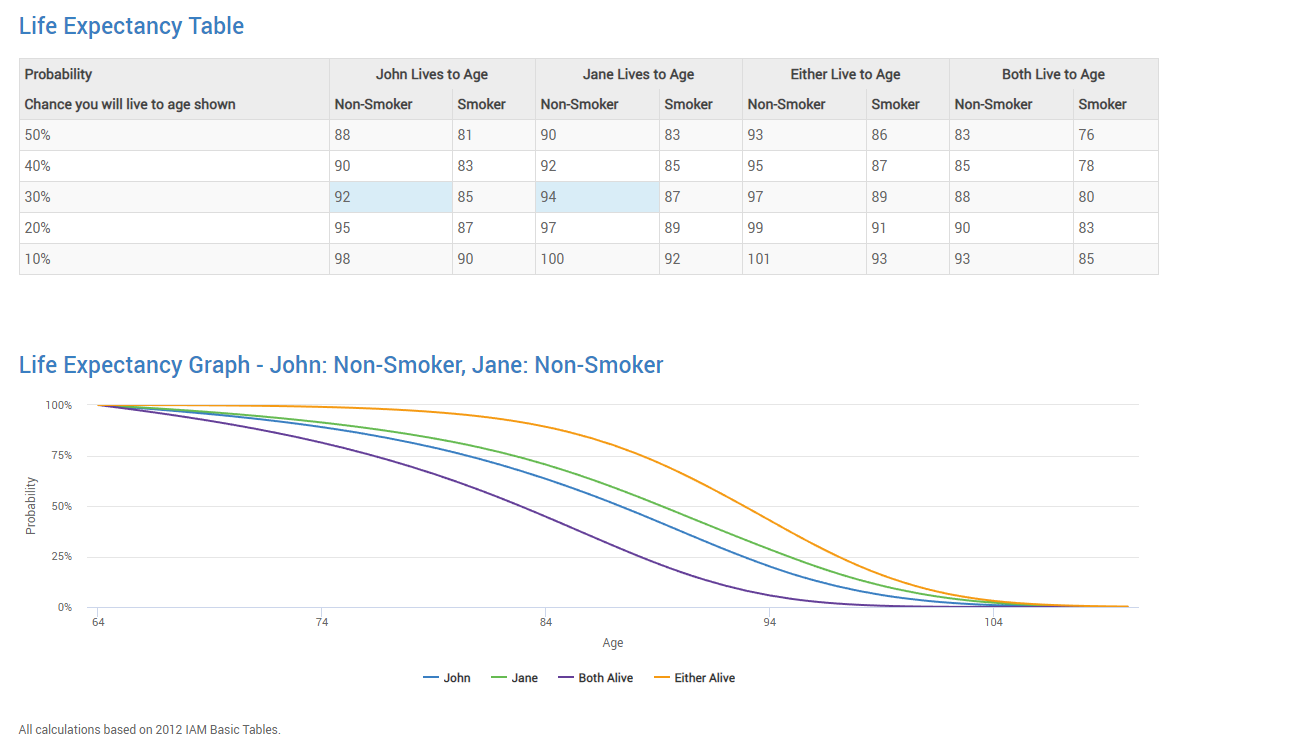

The chart below comes from our financial planning software. The couple (John and Jane Doe) are both aged 65, non-smokers and in good (but not excellent) health. There is a 40% chance that John lives to age 90 and a 50% chance that Jane lives to age 90. Many retirees would leave it at that level of consideration. A very important further point is that there is a 66% chance that one of them will live to age 90, a 49% chance that one will live to age 93, and a 37% chance that one will live to age 95. Assuming a life expectancy to 90 or older is no longer something to dismiss. We often assume the 30% probability – this would be age 92 for John and 94 for Jane. For those younger than retirement age, you should assume an even higher likelihood of living to 90+.

So what is the takeaway from this? A realistic life expectancy built into your financial plan for starters. For someone age 40 planning on retiring in your 50’s – you are either going to have to adjust your thinking (dreaming?) or do some serious saving. You potentially will need to fund a retirement longer than your working years. A natural progression would be as life expectancies increase, retirement age increases. A delay of retirement for several years can have dramatic improvements in a financial plan as a worker typically at the peak of their earnings can save significant amounts instead of withdrawing from their nest egg. Unfortunately, health issues and job insecurity may lead to early retirement. Working part-time or working at a more enjoyable and maybe lower paying job during retirement might be an option. Make an informed decision on when to start social security and don’t reflexively start at the earliest age possible – social security is an annuity and Uncle Sam does a poor job at pricing so it generally makes sense to delay your starting date. And enjoy your longer life – there are worse problems to have!

Douglas M. Lynch, CPA, CFA, CFP