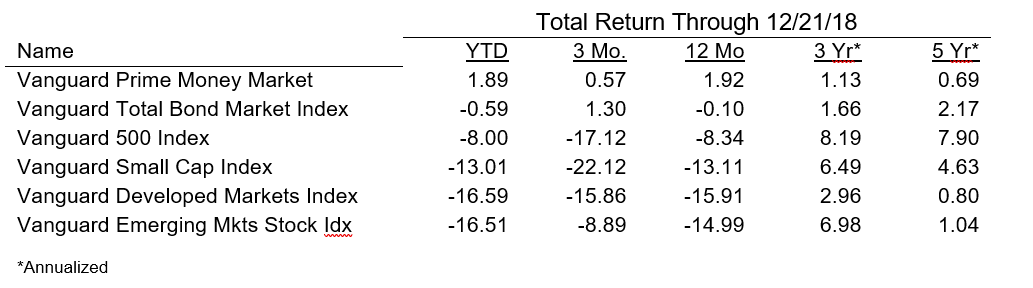

The global stock markets have declined significantly during the fourth quarter (see below) and just ended a particularly poor week. This week began with additional declines as we write this just prior to the close today.

There are numerous culprits for the recent selloff (federal reserve, slower global economic growth, trade war, looming government shutdown, etc.) and there is an element of truth to some or all of them. A reason that we don’t hear as much in the financial news but that we have tried to convey to clients during meetings and other communications is that the U.S. stock market simply rose faster than the underlying fundamentals in recent years and therefore was overvalued and vulnerable to declines once sentiment turned. As with the decline in February of this year, the speed of the declines supports the adage that the stock market is like an escalator on the way up and elevator on the way down.

Declines are obviously unsettling as they happen. We would offer the following to hopefully alleviate some of your concern:

Diversification has worked – your asset allocation was developed taking into account your risk tolerance and time horizon. For clients with lower risk tolerance and/or time horizons, you have a lower allocation to stocks. While bonds have not performed particularly well year to date (slight loss), they have done fairly well the past 3 months (+1.3%). Emerging market stocks have performed quite poorly year to date (-16.5%) but have actually outperformed by 7%+ this quarter relative to other equities. Our positions in PIMCO All Asset have also held up well during the declines.

Valuations are better – we noted above that U.S. stocks were overvalued. The good news is that they are less so now after a year of strong earnings growth and negative returns. Equities outside the U.S. were more attractive from a valuation standpoint going into the recent declines and are even more so now. The result is an increase in our expected returns over the next 5-10 years for all equities. That is the good news. The bad news is that this tells us nothing about what will happen next week, next month, or next year. That is the nature of the markets. We continue to believe in the value of fundamentals and valuation in determining longer-term forecasted returns but they are not helpful in predicting short-term moves.

For those in withdrawal mode, we have placed your anticipated withdrawals over the next several years in very safe (money market and short-term bonds) investments that we will not be subject to the wild price swings of stocks.

For those in the accumulation mode, declines in markets allow you to purchase more shares with additional savings (401(k) contributions for example).

For clients with higher risk tolerance, you have a longer time horizon to ride out down markets.

This is normal – while the quickness of the declines is somewhat unusual (as was the declines in February), declines in stocks of 10-20% or more are historically routine and investors should expect to experience them every year (10% declines) or few years (20%+ declines).

We continue to monitor all the capital markets and may make modifications (likely increases in equities) should stocks decline further. The initial modifications would be to return our portfolios to a more normal allocation as we have been positioned somewhat more conservatively. We have reviewed portfolios for tax losses and taken those in client portfolios when available and reinvested the proceeds into similar type investments.

We welcome any questions via email or phone should you wish to discuss your portfolio or any other issues.

Douglas M. Lynch, CPA, CFA, CFP

John C. Lynch, CPA, CFA, CFP